What is the financial standing of this individual, and why might it be of interest? A precise understanding of an individual's financial position can offer a glimpse into their economic impact and influence.

An individual's net worth represents the total value of assets minus liabilities. This figure encompasses various holdings, including real estate, investments, and personal possessions. It is a snapshot in time and can fluctuate based on market conditions and personal decisions. Publicly available information regarding an individual's net worth may or may not reflect the full picture of financial standing. A lack of publicly available information may highlight a desire for privacy.

Public knowledge of financial standing can provide insights into an individual's career success, business ventures, and financial strategies. It can be relevant to understanding market trends, economic impacts of individuals, or their role within a specific industry. Further, a comprehensive understanding of financial status and impact can be vital to evaluating an individual's potential influence or their presence on the economic landscape. This information can be utilized by investors, researchers, and the public seeking a broader understanding of an individual's impact.

Moving forward, a deeper investigation into this individual's financial aspects would require detailed analysis of publicly available financial records and potentially, expert insights, to effectively and comprehensively discuss the individual's impact.

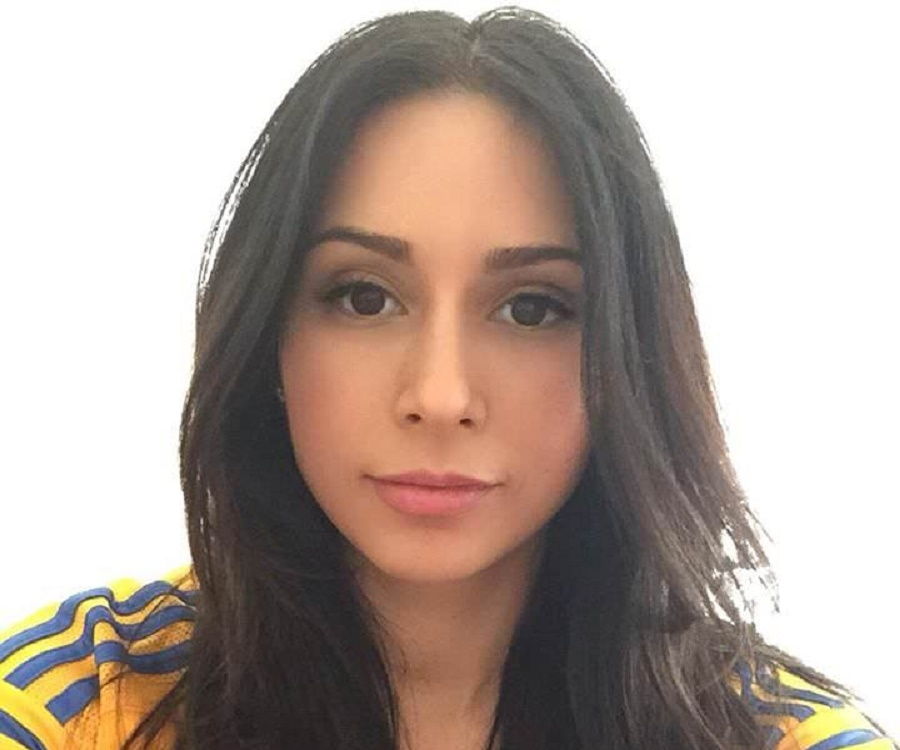

Patricia Azarcoya Schneider Net Worth

Understanding Patricia Azarcoya Schneider's financial standing requires consideration of various factors influencing her overall economic position. This involves examining her income sources, investments, and debts to gain a comprehensive perspective.

- Financial assets

- Investment portfolio

- Income streams

- Business ventures

- Real estate holdings

- Debt obligations

- Public records

- Privacy considerations

These key aspects collectively paint a picture of her financial status. Examining financial assets, including investments and real estate, reveals significant holdings. Income streams from various sources, potentially including business activities, contribute substantially to her overall wealth. However, debt obligations and lack of readily accessible public records can hinder a complete analysis. Understanding the interplay of these elements provides insights into her economic influence and impact. For instance, a large investment portfolio often suggests significant financial success, whereas considerable debt could indicate substantial financial risk. This nuanced approach ensures a more comprehensive understanding of her overall financial position. The inclusion of privacy considerations acknowledges the limitations and ethical considerations in exploring such information.

1. Financial Assets

Financial assets are integral components in determining an individual's net worth. Their value and composition significantly impact the overall financial standing. Understanding the nature and extent of these assets provides crucial insights into the economic position of an individual such as Patricia Azarcoya Schneider.

- Investments

Investments, including stocks, bonds, mutual funds, and real estate, are crucial elements of financial assets. The performance of these investments directly influences the value of the portfolio, and consequently, the net worth. Fluctuations in market conditions can significantly impact the value of investment holdings. The types and diversification of these investments provide insights into financial strategy and risk tolerance.

- Real Estate Holdings

Real estate holdings, such as residential or commercial properties, often represent a substantial portion of financial assets. The value of these properties depends on various factors, including location, market conditions, and property condition. Appreciation or depreciation of real estate directly affects the overall net worth. The presence and type of real estate holdings can offer further insights into the economic standing of an individual.

- Liquid Assets

Liquid assets, such as cash, bank accounts, and readily convertible investments, are essential for financial flexibility. Sufficient liquid assets provide financial security and enable individuals to meet short-term and unexpected financial obligations. The level of liquid assets within the overall financial portfolio can indicate financial stability. The presence of readily available cash can offer insights into financial prudence and preparedness.

- Other Assets

Other financial assets, including art collections, collectibles, or intellectual property, can contribute to net worth but might be less liquid and more challenging to value compared to traditional assets. The existence and nature of such assets can provide further insight into an individual's financial portfolio and economic influences.

The diverse array of financial assets plays a key role in shaping the overall net worth of an individual. Considering these different asset categories offers a holistic view of their financial position, contributing to a deeper understanding of how these components impact the broader economic landscape. Further analysis would require specific information about Ms. Azarcoya Schneider's financial portfolio.

2. Investment Portfolio

An investment portfolio is a crucial component in determining an individual's net worth. The composition and performance of investments directly influence the overall financial standing. For Patricia Azarcoya Schneider, as for any individual, the portfolio's value is a significant factor in calculating overall net worth.

- Asset Allocation

The distribution of investments across various asset classes (stocks, bonds, real estate, etc.) is a key element. A well-diversified portfolio aims to mitigate risk by spreading investments across different sectors. The specific allocation choices, whether conservative or aggressive, indicate potential risk tolerance and investment strategies. This directly affects the overall stability and growth potential of the portfolio, which, in turn, impacts the individual's net worth.

- Investment Performance

The returns generated by investments are directly reflected in the portfolio's value. Strong performance over time contributes significantly to a rising net worth. Conversely, poor investment choices can lead to portfolio losses, negatively impacting the overall financial position. Understanding the historical performance of investments in the context of market trends helps to assess the potential future value and risk profile.

- Investment Strategies

The approach taken to managing investments, encompassing strategies like value investing, growth investing, or dividend investing, shapes the portfolio's growth trajectory. The specific strategies adopted by an investor influence the expected returns and risk levels. An individual's investment strategies provide insights into their risk tolerance and financial goals.

- Market Conditions

External market forces significantly impact an investment portfolio's performance. Economic downturns, inflation, interest rate changes, and global events influence the value of holdings. Analyzing how market fluctuations affect the portfolio's value provides context for assessing the individual's financial resilience.

In conclusion, an individual's investment portfolio is integral to understanding their overall net worth. A well-managed, diversified portfolio, alongside sound investment strategies, can contribute significantly to long-term financial stability. Conversely, poor choices or unfavorable market conditions can negatively impact the overall financial position. Analyzing the portfolio's structure, performance, and the interplay of various factors is critical for evaluating the full picture of an individual's economic standing.

3. Income Streams

Income streams are a critical component in determining an individual's net worth. The variety, stability, and overall value of income sources directly impact the accumulation and maintenance of wealth. For Patricia Azarcoya Schneider, as for any individual, understanding these sources is vital to assessing her total financial position.

- Employment Income

Earnings from employment represent a primary income source for many. Salaries, wages, commissions, and bonuses contribute significantly to overall income. The level of employment incomeincluding compensation, benefits, and job securitydirectly correlates with overall financial stability. Stable employment generally leads to predictable income, influencing the ability to save and invest, and therefore, net worth.

- Investment Income

Returns from investments, such as dividends, interest, and capital gains, represent another key source of income. Investment strategies and market performance significantly affect this component of income. Well-managed investments can generate consistent returns, increasing net worth over time. Fluctuations in market conditions can impact the value of investment income.

- Business Income

Individuals involved in business ownership or entrepreneurship have income streams derived from business operations. Profit margins, sales volume, and strategic business decisions greatly influence business income. The stability and scalability of the business directly impact the predictability and potential growth of this income component. For someone like Patricia Azarcoya Schneider, potentially involved in multiple ventures, this source of income is likely complex.

- Passive Income

Passive income streams are generated from sources that require minimal ongoing effort. Examples include rental income from properties, royalties from intellectual property, and income from other investments. The consistent generation of passive income can contribute to financial stability and increase the total income portfolio, indirectly impacting net worth.

In summary, income streams, whether active or passive, from employment, investments, or business activities, all play crucial roles in building and maintaining net worth. A diverse range of income sources, particularly those that are both stable and scalable, can contribute to financial security and long-term wealth accumulation. The specific nature and value of these income sources would be crucial in assessing the overall financial position and influence of Patricia Azarcoya Schneider.

4. Business Ventures

Business ventures undertaken by an individual directly impact their net worth. Success in these ventures leads to increased assets, while failures can result in reduced wealth. The nature and profitability of business activities are significant factors in determining overall financial standing. The involvement in business ventures, including the success or failure of ventures, affects the overall net worth. The existence and performance of business activities serve as crucial factors influencing wealth accumulation or reduction. For example, a successful entrepreneurial endeavor can rapidly increase net worth, while a poorly managed business can diminish financial resources. The connection between business ventures and net worth is undeniable, as success fosters wealth accumulation and failure can lead to substantial financial losses.

The type of business venture significantly influences the impact on net worth. A venture focused on high-growth, high-risk industries might yield substantial returns but carries greater risk. Conversely, a stable, established business within a more predictable sector could provide a steady, albeit potentially lower return. The profitability and sustainability of these ventures are critical components. The long-term viability of a business venture directly influences the accumulation of wealth and the eventual impact on net worth. This is illustrated by comparing a rapidly growing tech startup with a well-established retail chain. The former might experience higher growth potential but faces a higher chance of failure, while the latter has a more predictable return on investment, albeit likely less explosive growth. The level of risk and the sector of the business influence the potential impact on the individual's overall net worth.

Analyzing the correlation between business ventures and net worth is critical for understanding an individual's financial position. The success or failure of ventures directly affects the individual's assets and liabilities. A deep understanding of the relationship between these factors is important for investment strategies, risk assessment, and for a broader understanding of the economic impacts. This understanding is fundamental to evaluating the potential impact of various business pursuits on an individual's financial standing and is crucial for investors, business analysts, and anyone interested in understanding the impact of entrepreneurial endeavors on economic outcomes.

5. Real Estate Holdings

Real estate holdings are a significant component of an individual's overall net worth. The value and type of real estate possessions directly influence the total financial standing. For Patricia Azarcoya Schneider, as for any individual, the presence and value of real estate holdings are a key factor to consider when evaluating her overall financial position.

- Property Valuation and Location

The market value of real estate is a primary determinant of its contribution to net worth. Location significantly impacts valuation, as properties in desirable areas typically command higher prices. Factors such as proximity to amenities, infrastructure, and prevailing market trends influence the worth of real estate assets. Analysis of property location and market conditions offers insight into the strategic implications for investment decisions.

- Types of Properties and Portfolio Diversity

The types of properties held, whether residential, commercial, or mixed-use, contribute uniquely to a portfolio's overall value and risk profile. Residential properties often provide long-term appreciation potential. Commercial properties can generate rental income, while land holdings might be viewed as a source of future development value. Diversification within real estate holdings mitigates risk, providing a more stable investment portfolio. Analysis of property type and diversification offers insights into an individual's investment approach and potential risk tolerance.

- Acquisition Costs and Financing

Acquisition costs, including purchase price, closing costs, and associated expenses, directly influence the financial outlay. Financing options, such as mortgages and loans, also affect cash flow and potential returns. Understanding how these costs and financing structures are managed reveals insights into the individual's financial strategies and risk appetite. Analyzing these cost structures can provide context for evaluating the true cost and potential return of real estate holdings.

- Income Generation and Return on Investment (ROI)

Real estate investments can produce rental income, impacting an individual's cash flow. The return on investment (ROI) varies significantly depending on property type, location, and management. Evaluating the income generated and the return on investment provides insights into the efficiency and profitability of real estate holdings within the overall financial portfolio. Assessing the income streams, including rental income, capital gains, and depreciation benefits, is important in understanding the real estate investments and their role in overall net worth.

In conclusion, real estate holdings are a crucial element in evaluating Patricia Azarcoya Schneider's net worth. Their value, type, location, acquisition costs, and income generation potential all contribute to the overall picture. A comprehensive analysis considers these factors to assess the full extent of real estate investments' impact on her financial standing and their influence on her overall economic position.

6. Debt Obligations

Debt obligations significantly impact an individual's net worth. The presence and amount of debt directly affect the calculation of net worth, representing liabilities that must be subtracted from total assets. Understanding the nature and extent of these obligations provides crucial insights into the overall financial health and stability of an individual like Patricia Azarcoya Schneider.

- Types of Debt

Various types of debt influence net worth. Mortgages on real estate, loans for vehicles or other assets, and outstanding credit card balances are common examples. The size and terms of these debts, including interest rates and repayment schedules, directly affect the net worth calculation. Analyzing the diversity and nature of debt obligations reveals insights into financial priorities and strategies.

- Debt-to-Asset Ratio

The relationship between total debt and total assets, often expressed as a ratio, is a key indicator of financial risk and leverage. A high debt-to-asset ratio suggests a greater reliance on borrowed funds, potentially leading to financial strain or reduced ability to weather economic downturns. The analysis of this ratio provides context for the individual's financial standing in relation to their assets.

- Impact on Cash Flow

Debt obligations directly affect cash flow. Repayment commitments for various debts require regular cash outlays. Understanding these financial obligations helps to assess an individual's ability to generate and manage cash flow efficiently, thereby influencing the overall financial health. The level of debt repayment impacts the individual's available capital for other activities, such as investments or savings.

- Interest Expense

Interest payments associated with various debts can represent a substantial ongoing expense. The accumulation of interest adds to the total debt burden over time. This expense has a direct bearing on profitability and cash flow. The impact of interest expenses on the overall financial position is crucial in evaluating the overall economic impact of debt obligations.

In conclusion, debt obligations are a crucial consideration in evaluating the net worth of an individual such as Patricia Azarcoya Schneider. A thorough examination of debt types, the debt-to-asset ratio, their impact on cash flow, and interest expenses provides a comprehensive understanding of the financial position and the potential risks associated with debt. Without precise figures, a complete assessment is impossible, but the principles illustrated above apply broadly.

7. Public Records

Public records play a significant role in understanding an individual's financial standing, though they are not a definitive measure of net worth. The availability and nature of these records influence the extent to which an individual's financial position can be assessed publicly. For someone like Patricia Azarcoya Schneider, as with any individual, public records may or may not be extensive enough to definitively determine net worth. The existence of public records, however, enables a degree of transparency that impacts understanding of financial matters. This information can include details about property ownership, legal judgments, business filings, and other publicly accessible financial documents.

Publicly accessible information, such as property deeds or business registration records, can offer insights into an individual's asset holdings and financial activities. Court records, for instance, may detail judgments or settlements relevant to financial matters. Corporate filings, if applicable, can reveal details about business transactions, ownership structures, and potential liabilities. However, the absence of such records does not necessarily indicate a lack of significant assets or financial complexity; privacy protections and personal choices may lead to a lack of public information. Interpreting these records requires a cautious and nuanced approach to avoid misinterpreting the information.

The practical significance of public records in evaluating net worth stems from their ability to provide context and potential indicators, but they are not a comprehensive evaluation. One cannot definitively determine net worth from public records alone. These records are valuable as a source of corroborative evidence or potential clues, but a complete understanding of a person's financial status requires additional information and analysis. While public records may offer insights into asset ownership and financial transactions, they often do not fully reflect the complexity of an individual's financial affairs. The presence or absence of public records, therefore, should be considered within the broader context of individual circumstances and privacy considerations. This careful evaluation allows for a more nuanced and informed understanding of financial standing, rather than relying solely on potentially incomplete or selective public information.

8. Privacy Considerations

The exploration of an individual's net worth, like that of Patricia Azarcoya Schneider, inevitably intersects with privacy considerations. The desire for personal financial information to be protected often contrasts with the public's potential interest in understanding such details. This tension necessitates a careful and nuanced approach to balancing these competing interests.

- Right to Privacy and Financial Data

Individuals possess the right to privacy regarding their financial affairs. This right stems from the recognition that personal financial information is sensitive and can be vulnerable to misuse. The protection of this information is often a matter of legal and ethical considerations. This right to privacy applies equally to public figures, though the public's interest in their activities, including financial matters, may sometimes be deemed outweighing this privacy concern. The implications of this right are particularly relevant in circumstances involving the disclosure or speculation surrounding Patricia Azarcoya Schneider's net worth.

- Potential for Misinformation and Misinterpretation

Public speculation regarding net worth, particularly in the absence of precise figures, can lead to inaccurate or misleading information. The absence of clear, verifiable data can allow for assumptions and conjecture. This potential for misinformation or misinterpretation underscores the importance of responsible reporting and the need for individuals to be cautious in interpreting financial data without proper context. For instance, rumors or speculative estimations about Patricia Azarcoya Schneider's net worth may be circulated if publicly available data is limited or absent.

- Impact of Media Representation and Public Perception

Public figures, including individuals whose work leads to public recognition such as Patricia Azarcoya Schneider, are often subject to media scrutiny, which may encompass details relating to wealth and finances. The way the media represents financial data, whether highlighting certain aspects or focusing on particular narratives, can influence public perception. Responsible media portrayal and careful consideration of the potential impact on an individual's reputation and well-being are crucial aspects in covering such issues. This is particularly pertinent to understanding how public portrayals of Patricia Azarcoya Schneider's net worth might be shaped and perceived.

- Ethical Considerations in Financial Reporting

Ethical guidelines and principles governing financial reporting are crucial in ensuring transparency and accountability, especially when dealing with sensitive personal data. These guidelines dictate the accuracy and fairness in reporting financial information, whether it is about individuals like Patricia Azarcoya Schneider or any other person. Adhering to these principles is imperative for maintaining credibility and avoiding potential harm. Ethical reporting standards, when applied appropriately, ensure respect for privacy and responsible public disclosure in sensitive situations.

In summary, the intersection of privacy concerns and public interest in an individual's net worth, like that of Patricia Azarcoya Schneider, demands a delicate balance. Responsible reporting, sensitivity to privacy rights, and an understanding of the potential for misinformation are essential to navigating this complex issue. The presence or absence of public records, the nature of financial reporting practices, and societal expectations about public figures all contribute to the challenging narrative surrounding this sensitive issue.

Frequently Asked Questions about Patricia Azarcoya Schneider's Net Worth

This section addresses common inquiries regarding the financial standing of Patricia Azarcoya Schneider. Accurate and reliable information regarding net worth is crucial, but precise figures are often unavailable or unverifiable.

Question 1: What is net worth?

Net worth represents the total value of assets owned, minus any liabilities. Assets include investments, property, and other possessions. Liabilities are debts or obligations. A precise calculation requires detailed financial records, which are often not publicly available.

Question 2: How is net worth determined?

Net worth is calculated by totaling all assets and subtracting all liabilities. Assets include various categories like cash, investments, real estate, and personal possessions. Liabilities represent debts, outstanding loans, and other financial obligations. Accurate determination necessitates comprehensive financial documentation.

Question 3: Why is it challenging to determine Patricia Azarcoya Schneider's precise net worth?

Precise net worth figures are often not publicly available for individuals. Privacy concerns, lack of public financial disclosure, and the complexity of calculating assets and liabilities create significant obstacles. Detailed financial information is typically not released except through official channels.

Question 4: What sources can provide insights into financial standing?

While precise figures are often unavailable, public records like property ownership or business filings can offer partial insights into financial status. However, such records do not represent a complete financial picture. Information from reputable sources, when available, can offer a more comprehensive context.

Question 5: Why is understanding net worth relevant?

Understanding net worth, even in a general context, can be relevant in assessing an individual's economic position, influence within a sector, and potential economic impact. While precise figures are unavailable, the presence of assets and potential liabilities can offer valuable insights.

Understanding net worth requires navigating potential privacy concerns and recognizing the limitations inherent in evaluating financial status from publicly available data. Reliable sources of financial information are crucial for proper analysis.

Moving forward, this inquiry necessitates a cautious approach to information and a focus on verifiable data to form a comprehensive picture.

Conclusion Regarding Patricia Azarcoya Schneider's Net Worth

This analysis of potential factors influencing Patricia Azarcoya Schneider's net worth highlights the complexities inherent in evaluating an individual's financial standing. While public records can offer some insights into asset holdings and potential income streams, a precise determination of net worth remains elusive. Key factors examined include the nature and value of financial assets, such as investments and real estate, alongside the presence and scope of any debt obligations. Further, the analysis underscored the limitations of relying solely on publicly available data, acknowledging the significant role of privacy considerations in shaping an individual's financial profile. Crucially, this exploration also underscores the importance of distinguishing between public records and a complete and accurate evaluation of net worth.

The absence of definitive data necessitates a cautious approach to interpreting potential influence. Future research may benefit from further analysis of available, reliable sources to gain a more complete and substantiated picture. Understanding the nuances of financial data and the challenges associated with evaluating the net worth of individuals, including high-profile figures, is essential. The ongoing importance of considering privacy constraints and methodologies for responsible financial reporting are essential in such circumstances. The ongoing pursuit of this information demands a keen focus on verifiable evidence and ethical considerations.

You Might Also Like

Kountry Wayne Height: Unveiling The Truth!Austin Mahone Age: How Old Is The Singer?

Diane Sawyer Photos: Stunning Portraits & Behind-the-Scenes Shots

Taya Kyle Net Worth 2023: A Look Inside

Grace Slick Stunning Photos - Today's Best Shots!

Article Recommendations

- Gerard Butler 2024 The Journey Of A Hollywood Icon

- Dian Parkinson Latest News Insights

- Ryan Kaji Top Toys Amp Unboxing Videos